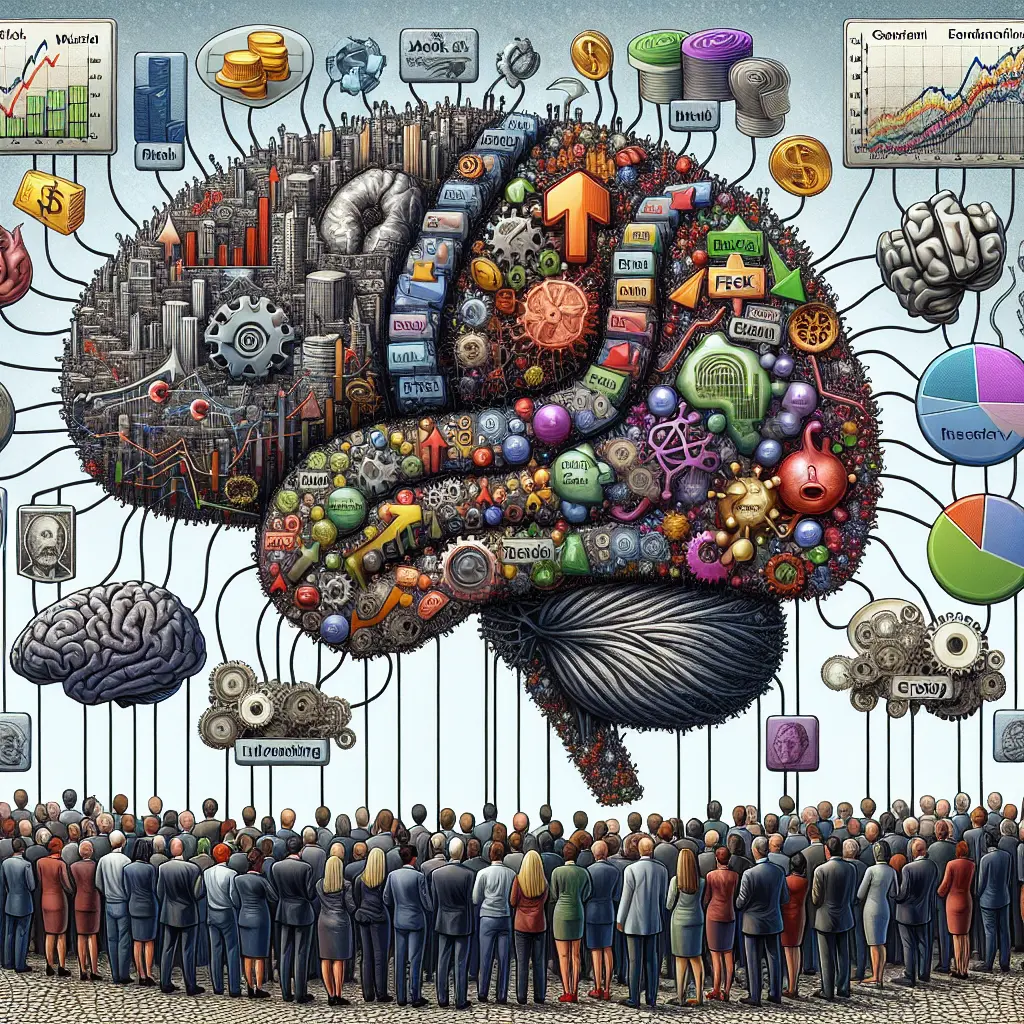

Understanding the Psychology of Investing and Behavioral Finance

In today's fast-paced and often unpredictable financial landscape, grasping the psychology of investing is more critical than ever. As markets react to various factors, from economic reports to geopolitical events, investor behavior—shaped by cognitive biases and emotional reactions—plays a pivotal role in shaping financial outcomes. Behavioral finance provides a framework for understanding these psychological influences and offers strategies for improving decision-making in investing.

Cognitive Biases in Investing: Overconfidence and Loss Aversion

Cognitive biases are systematic patterns of deviation from rational judgment, often leading investors astray. Overconfidence and loss aversion are two prevalent biases in the investment world. Overconfidence can cause individuals to overestimate their knowledge or ability to predict market movements, leading to excessive risk-taking. Conversely, loss aversion reflects a tendency to prefer avoiding losses over acquiring equivalent gains, which can result in overly conservative investment strategies or panic selling during downturns.

For instance, recent news about Home Depot's persistent decline in same-store sales highlights how overconfidence can mislead both individual and institutional investors. Ignoring underlying issues can lead to inflated valuations. It's crucial for investors to remain grounded in data and diversify their portfolios to mitigate the risks associated with overconfidence explore more on Forbes.

Emotional Investing: The Impact of Fear and Greed

Emotional investing is often driven by powerful forces like fear and greed, leading to suboptimal investment decisions. Market psychology is particularly susceptible to these emotions during times of volatility. The fear of missing out (FOMO) can prompt investors to chase trends without thorough analysis, while fear itself can trigger panic selling during downturns, as seen in the volatile reactions to cryptocurrency regulations learn more on CoinDesk.

Understanding risk perception in finance is crucial for overcoming emotional investing. By focusing on long-term goals and maintaining a disciplined approach, investors can better withstand market fluctuations and avoid reactionary decisions driven by fear or greed.

Mental Accounting and Anchoring Bias in Investing

Investment psychology explores how mental accounting—categorizing money into different accounts based on subjective criteria—can skew perceptions of value and risk. This bias often leads investors to irrational decisions, such as treating dividends as income rather than capital return. Similarly, anchoring bias can cause individuals to fixate on specific price points, ignoring broader market dynamics.

For example, support for new leadership, as seen with the Secretariat pledging support for a new chair, can be perceived differently based on previous experiences with similar scenarios details on BBC News. Anchoring on past outcomes without considering current contexts may lead investors to miss out on new opportunities or hold onto outdated strategies.

The Role of Herd Behavior in Finance

Herd behavior in finance occurs when individuals follow the majority, often resulting in significant market swings. This behavior was evident during the recent surge of interest in women's sports sponsorships, like the major deal launched by First Lady with Prophet Magaya's support insights on The Guardian.

While aligning with market trends can sometimes be beneficial, it’s essential to balance these tendencies with independent analysis. Behavioral economics provides tools like heuristics and prospect theory to help investors understand when following the crowd is prudent versus when it might lead to financial pitfalls.

Psychological Factors in Investing: Confidence Levels and Emotional Resilience

Investor psychology emphasizes the importance of individual differences in decision-making. Confidence levels and emotional resilience are psychological factors that greatly influence financial outcomes. Developing emotional resilience allows investors to maintain composure during market turbulence, thereby enhancing decision-making capabilities.

Incorporating strategies such as high-impact tutoring to build resilient schools locally underscores the importance of education and personal development in achieving long-term success explore further on Education Week.

Applying Behavioral Finance Insights: Strategies for Better Financial Decision Making

The study of behavioral finance equips investors with insights into financial heuristics and cognitive processes behind investment choices. By recognizing biases such as mental accounting or loss aversion, investors can adopt strategies that enhance decision-making:

- Diversification: Mitigates risks associated with overconfidence by spreading investments across various asset classes.

- Long-Term Perspective: Encourages a focus on long-term goals rather than short-term market fluctuations.

- Education: Informs about common cognitive biases and emotional triggers.

- Professional Advice: Utilizes expert guidance to counteract personal biases.

The costliest cyberattacks since 2020 serve as a reminder of the unpredictable nature of modern risks discover more on Cybersecurity Ventures. Just as organizations implement robust cybersecurity measures, investors should adopt comprehensive strategies that consider both psychological and market factors.

Conclusion: Navigating the Psychological Landscape of Investing

Understanding the psychology of investing is not just about recognizing biases but actively applying this knowledge to improve financial decision-making. By leveraging insights from behavioral finance, investors can balance risk and reward more effectively, ultimately paving the way for more rational and successful financial decisions.

As we continue exploring these concepts, we invite you to reflect on your investment strategies. Are you aware of your cognitive biases? How do you manage emotional investing? By considering these questions and embracing the principles of behavioral finance, you can enhance your approach to the financial markets.

Join me, Gabriella Knox, as we continue to delve into the fascinating interplay of psychology and finance. Together, we can unlock the potential for more rational and rewarding investment strategies. Stay engaged, stay informed, and share your thoughts as we explore the evolving landscape of investing.